by Rita Baker | Sep 7, 2016 | Lean Startup

This post is the first of a series that will try to show how Lean Startup can be useful at various stages of an organisation’s life. My inspiration comes from entrepreneurs and intrapreneurs I have worked with throughout my career, who have wasted way too much of their time on projects that never reached the market.

This and following posts don’t, in any way shape or form, pretend to be the recipe to a successful startup or project. Hopefully, however, they will give entrepreneurs and intrapreneurs a new outlook on management, new ideas and new tools to help them achieve their goals.

What is Lean Startup?

What is Lean Startup?

I have often referred to Lean Startup as a tool box but it is so much more than that. Lean Startup:

- Gives you a way to look at problems and questions that always keeps in mind the raison d’être of your organisation

- Helps you to prevent wasting your time developing products or services that no one wants or is willing to pay for

- Exposes you to management tools and processes adapted to extreme market uncertainty

- Brings structure and discipline during chaotic times hence reducing some of the risks

- Creates a culture that enables the real power of any organisation; maximising the use of the brain power and creativity of internal and external resources

- Introduces you into a community of people whose mindset is to help one another.

In my observations these last two elements, although not the better known ones in Lean Startup, are the most powerful ones.

Understanding the basics of Lean Startup is necessary if you wish to apply it in your organisation. This series will not spend much time explaining them, instead focusing on the practice of Lean Startup. Hence I am sharing with you a short list of what I consider the best references to understand Lean Startup. These are not even the tip of the iceberg as to what can be found on the web. They are, however, sufficient to give you an excellent comprehension of the basics and more.

There are millions of other web references. Many of them are excellent.

If you are new to Lean Startup, I urge you to start with the references above.

Lean Startup is getting to be a bit like a holy book. Some read it and understand the concepts behind it and apply them well. Others read it, retain the words but don’t really understand the concepts behind them so they interpret it their own way, sometimes with disastrous results. Yet others still, haven’t even read the book, use the buzz words like MVP and pivot but have no clue as to what they really mean. Hence, always be critical of what you read on Lean Startup, even the posts on this blog.

Why we need Lean Startup

Why we need Lean Startup

Organising the Montreal Lean Startup Circle, as well as working with entrepreneurs as a consultant, a coach and a mentor, has proven to me that when properly applied, Lean Startup has the potential to take a mediocre idea and evolve it into a lucrative business (figuratively in the case of NPOs). It will also show quickly when an idea is so bad (in the context of achieving your business goals) that it needs to die.

Current management models, which were created in a different era, are no longer suited or efficient in uncertain markets. The astronomical failure rates of startups in North America and the incapacity of our large enterprises to innovate are proof.

It is time to think differently. It is time to act intelligently.

This series will examine how Lean Startup can be applied throughout the entire life cycle of an organisation. Our next post will look at how Lean Startup can help during the ideation stage.

[1] In case you ever wondered, Ries is pronounced rice in Europe but Eric, who is American, pronounces his last name reess.

by Rita Baker | Mar 10, 2016 | Lean Startup

***This post has been revised following some input by David Binetti ***

Now that we have looked at the why, what and how of innovation accounting, let’s dig deeper and take a look at one of the most exciting tools to come out of innovation accounting: Innovation options.

What are Innovation Options?

Innovation options, created by the father of innovation accounting, David Binetti, follow a similar principle to financial market options.

In finance, an option is a contract which gives the buyer the right, but not the obligation, to buy or sell an asset or instrument at a specified strike price on or before a specified date. In everyday life, we use the option principle when we buy a life insurance policy.

An innovation option is a financial instrument which lets a potential investor see the maximum market value of a start-up or other innovation project at a specific date in time. It also shows the overall risk of the project. Hence the investor can choose when and how much to invest according to the return/risk ratio he/she is looking for.

Innovations options are meant to be used with disruptive innovation projects. When there is no presumption of success.

How do Innovation Options Work?

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

Given the formula may scare off even the bravest of us, I will instead direct you to a web page David has gracioulsy put up (http://innovation-options.com/) where you can input your data and the embedded program will make the calculations.

The model calculates every possible value of a start-up or innovation project, at a given date, for three types of outlooks: positive, neutral or negative.

In order to get to the potential values at time x of your project or start-up, you need to input the following data in the model.

Costs

There are two types of costs; your seeding costs, the ones associated with your inital funding needs and the costs associated with taking your company or project to the next level aka the big bet.

Your seeding costs include the funds needed to cover your initial start-up activities in order to test your hypotheses and get to a point where you are reasonably certain you have achieved product/market fit. This can be seen as the premium on the option itself.

The second type of costs are the ones associated with scaling your company or taking your project to the next level (provisioning costs). It could mean going from prototype mode to full blown internal production and/or going from addressing local markets to going after international markets.

Potential

Your start-up or project potential refers to what you think it’s market value will be at the term of the option. There are many ways to estimate this number. It is a function of your revenues, assets and intangibles. It is the answer to What do you think your start-up or project could sell for (after the seeding round or scalling depending on the type of financing you are looking for) in the market?

Time horizon (or option term)

This period is usually defined by the duration of your project or how long you can last given the amount of money you are asking for (aka your runway).

Number of reporting periods

The innovation option framework is based on using some kind of agile, iterative development methodology such as Lean Startup. Hence you need to decide how often you will report the results of your experiments to your investors. These reports should include the type of information you have in your innovation accounting log.

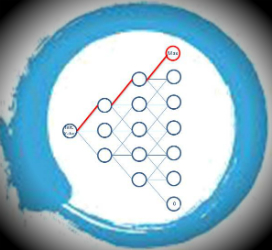

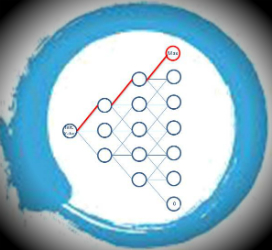

The output of a model, with 3 reporting periods, will look like this:

Each vertical row of values represents a reporting period. In order to get to your startup/project maximum valuation (top right corner), you simply need to see if your experiment results for the period proved your assumptions (you go up), were inconclusive (you go straight), or disproved your assumptions (go down). A scenario where your experiments proved your underlying assumptions for all reporting periods would look like this:

Aside from this graph, the econometric model will also yield the risk sigma (or measurement of the level of risk) of the project. The risk sigma is a comparable measure between projects that is inversely related to the number of reporting periods. In other words, the faster (and more often) you iterate on your market experiments the lesser the overall risk of the project (but the higher the costs as well[1]). If you think about this a bit it’s just common sense. The more often you check in with your potential customers to ensure the product you are working on answers their needs, the higher the probability they will buy it once it’s in the market. You can check out David Binetti’s presentation at the 2015 Lean Startup Conference for additional information on how the innovation option model works.

Why are Innovation Options Game Changers?

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions.

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions.

Investors will have a framework that reassures them that all is being done to minimise the commercialisation risk of the project. They will also be able to compare the risk of one project to others and pick the ones that fit best with the overall risk/return strategy they have for their portfolio.

Investors will be able to easily put a $ value to any project thus making it possible for companies of all sizes, and not just entrepreneurs, to work internally on disruptive innovation projects.

Finally, one could even see down the road, banks and other more conservative financial institutions getting into innovation financing at earlier stages. This will result in more financing options for entrepreneurs and intrapreneurs thus decreasing the cost of funding a project.

As an end result, it would make disruptive innovations a more mainstream occurrence. This would have a pretty significant impact on our economies and our lives.

What is Needed to Get There

However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

Finally, the biggest obstacles to overcome, in the use of innovation accounting and innovation options, are the culture and the required changes in the ecosystems of the financial sector. These sectors have deeply entrenched ways of doing things and are not innovative by nature.

It may just take a Google, Amazon, Intuit or other innovator, outside of the financial sector, to start financing innovations at large and shake things up.

Will innovation accounting and innovation options be the meta disruptive innovations that will bring about profound changes in the creation of disruptive innovations? The potential is there.

[1] Hence, learning how to do your experiments with the least amount of resources (MVP way) will increase the maximum value of your start-up/project.

by Rita Baker | Mar 2, 2016 | Lean Startup

In the previous post we looked at why we need innovation accounting and its definition. This post’s purpose is to understand how innovation accounting is done.

When working on getting an innovation to market, whether while setting up a new company or through an internal project, you first start with an idea. Through a series of experiments you test your idea and refine it until you can reach your goal (usually when starting a new company the goal is to achieve product/market fit).

Innovation accounting is the defining, measuring and communicating of this series of experiments. This can be done a number of ways. When using the Lean Startup methodology, it is done through the Build-Measure-Learn process.

Eric Ries’ The Lean Startup book explains in detail the methodology and you can also find over a dozen videos on the web that details how to conduct an experiment. The Javelin experiment board video is a classic. Hence I will only give a brief summary of the methodology here.

Innovation Accounting Step 1: Build

Once you have identified your most critical assumption in your business model (one that must be verified in order for your business to be viable), you design an experiment to test your assumption.

It is important for your assumption to be worded in such a way that it can be validated or invalidated.

The experiment you design must allow you to test your assumption with the least amount of resources possible.

Ideally, your first experiments will be conducted directly with your target market. Either by observing them (ideal), having them act within a specific scenario (also ideal) or by interviewing them (less ideal).

Innovation Accounting Step 2: Measure

When designing your experiment, you will need to determine which metrics will be collected as well as a standard against which you will measure them.

Metrics collected from the web will come from your analytics data. Metrics coming from other sources will most often be collected manually.

Statistically reliable data is not necessary here. You simply need sufficient data to show a direction.

In the context of innovation accounting, your data must be actionable (it must tell you explicitly whether your can pursue your business model in its current form or whether you need to change it) and accountable (you should be able to recreate your experiment at a later date and get similar findings).

Above all, just like it is the case with regular accounting, your experiment must be conducted rigorously, using the highest standards. Otherwise the results of your experiments will be unreliable.

Knowledge in analytics and primary data collection are necessary to conduct valid experiments.

It is important to note here that innovation accounting is a burgeoning discipline. One of the areas that still needs to grow in order to provide better guidelines is how to pick standards for your experiments. At this time, it is left to the market experience of the entrepreneur to determine a standard for an experiment.

Innovation Accounting Step 3: Learn

Learning, while conducting your first experiments, is easy. You have not invested much time or resource in your project yet and backtracking, although not pleasant, can be done easily. As more resources are sunk into the project, pivoting on essential parts of your business model becomes increasingly difficult.

Validating your critical assumptions is the primary goal of your experiments. There is however, a very important secondary goal. That is to keep your eyes and ears open for any other learnings you can pick up along the way. Your early experiments are the ones that will most likely yield the most secondary learnings. Some of these learnings will be so critical that they may impact your business model just as much as not validating your assumption would.

Your innovation accounting log

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future.

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future.

Given I am fundamentally lazy and like simplicity above all, I use an Excel spreadsheet to keep a log of my experiments. The variables I keep track of, for each experiment I conduct, are the following:

- Critical assumption

- Market targeted

- Number of participants required

- Summary description of the experiment

- Start date of experiment

- End date of experiment

- Resources required

- What does my minimum viable product consist of

- Metric(s) to be measured

- Standard of the experiment

- Experiment results

- Additional learnings

- Has the critical assumption been validated or not?(color code the cell green or red)

- If not, what is the impact on the business model?

As you fill in your spreadsheet with the results of your numerous experiments, you are tracking innovation. The spreadsheet also serves to show, not only potential investors but collaborators as well, the road you have travelled to get to where you are. Too often it is thought that innovation is born from a single genius idea and a bit of work.

The innovation accounting log shows the size of the effort and the progression of ideas required to bring an innovation to market

Our third and last post of this series will take a look at how innovation options, a disruptive innovation in itself, can determine the maximum market value of an innovation.

by Rita Baker | Feb 16, 2016 | Lean Startup

Have you ever presented (pitched) your disruptive business idea – one that had yet to be seen in the market – to a venture capitalist, a CFO or a gating committee? If so, you know you need to come prepared with a solid business plan (deck).

The one part of your plan your investor will be the most concerned with is the financial forecast. Detailing costs is usually not a problem. The part however that requires you to put your creative hat on is the revenue forecast.

When presenting this forecast, you can most likely do so with a straight face with the numbers for the first few months. You know very well, however, that any number past this time horizon is based on wishful thinking rather than any market facts. Market facts would require some kind of market history. The problem is that a disruptive innovation is, by definition, not found in the market. Hence, keeping a straight face in front of an investor requires serious acting talent on your part. Fearing that at any time you will be called out.

When presenting this forecast, you can most likely do so with a straight face with the numbers for the first few months. You know very well, however, that any number past this time horizon is based on wishful thinking rather than any market facts. Market facts would require some kind of market history. The problem is that a disruptive innovation is, by definition, not found in the market. Hence, keeping a straight face in front of an investor requires serious acting talent on your part. Fearing that at any time you will be called out.

You can rest assured you won’t be called out. Why? Because your investor, if he or she has any experience at all with financing disruptive innovations, knows that the revenue numbers on your forecast in year 2 are probably less likely to be exact than the chance they have to win the jackpot with that lottery ticket they have in their wallet.

So why are investors and entrepreneurs still relying (or pretending to) on these financial forecasts to decide whether or not to invest in innovation projects? That is the question Eric Ries, author of The Lean Startup, asked himself.

As a serial entrepreneur he knew very well that forecasting sales revenue on an innovation project, never mind a disruptive one, with any accuracy was impossible until you achieved product/market fit (time when you have found the correct business model to generate consistent growth in your sales).

He also understood that investors needed to be reassured that the money they poured in the project, before product/market fit occurred, was used to achieve it and not dilapidated.

Those of you who are not yet familiar with the Lean Startup methodology, it requires the owner of an innovative project to do a series of market experiments in order to validate the underlying assumptions of his or her business model until the model that generates the maximum long term revenue is found.

These experiments, when done rigorously, generate reliable metrics. These metrics are measured against a standard to validate (or invalidate) the assumptions.

A multitude of experiments, done in rapid iterations, are required to test the large number of assumptions on which are based any start-up or project. When an experiment shows that an underlying assumption is not proven, this part of the business model must be changed. Experiments are conducted until the optimal business model is found and then continue during the entire life of the project to constantly adapt the model to market changes.

What is Innovation Accounting?

Innovation accounting is defining, measuring and communicating the process of innovating either in the context of a start-up or a project in an established organisation.

Innovation accounting is defining, measuring and communicating the process of innovating either in the context of a start-up or a project in an established organisation.

Innovation accounting uses the data generated by the experiments to determine, at a point in time, the maximum value of a start-up or project. The experiments data feed an econometric model similar to the ones used to calculate the value of stock derivatives in the financial sector. The maximum value of the start-up or project at a given time can be used by investors (venture capitalist or CFOs) to gauge how much they will invest given the returns they are targeting.

Now that we understand the why and what of innovation accounting, in the second part of this post, we will dive into how innovation accounting is done.

by Rita Baker | Dec 22, 2015 | Innovation, Lean Startup, Marketing

It is this time of the year. The time when we reflect on what we accomplished during last 12 months. What we did well and what we need to improve upon. It is also the time to consolidate our learnings for the year. One of the ways I circle back on my learnings for the year is to make a compilation of the books I read throughout the year and my best business reads list for the year.

I consider myself very lucky. My work requires me to not only keep up with what is going on in my field but keep ahead of the curve. Hence I need to read an average of probably 20-25 hours a week and I love it.

The one thing I noticed this year is that the marketing books I read were not my best sources of information to keep ahead of the marketing curve. Marketing is moving at the speed of light these days and the published book format is not well suited to keep you abreast of what is on and ahead of the curve. It is still however a great format to do a deep dive on a given topic.

Hence most of the marketing information I used to write my blog posts came from blogs or webzines. Therefore I will focus on my favorite cutting edge marketing information web sources for this year’s review.

As they are an inherent part of the services I offer to my customers I must also keep up on innovation and Lean Startup literature. I read many really great books on these two topics this year. It was hard to pick just a few for this review. Here are my best business reads for 2015.

Marketing

Hubspot

Hubspot

This site is designed to draw in affiliates. Hence the information is tailored for marketing consultants. Hubspot picks up quickly on new trends and is therefore an excellent source of information to keep on top of the curve marketing-wise.

eMarketer

eMarketer

eMarketer is a great source of market data. It also has some excellent white papers that draw a very clear picture of digital marketing, media and commerce. I especially like that they have extensive data on Canada and even some on Quebec.

CCO Magazine

CCO Magazine

The articles in the Chief Content Officer magazine are dedicated to content marketing which is an ever inclusive field. The articles are often in-depth and of excellent quality.

Honorable mention goes to the Harvard Business Review (HBR). Although it isn’t specifically a marketing magazine, their marketing articles are truly well researched and written by some of the most brilliant American marketing minds.

Many of my blog posts, including 3 Digital Makreting Hurdles, Me Inc, Influencer marketing, retargeting, community marketing and co-marketing were all inspired and researched using at least one of these sources.

Innovation

The very best book on innovation I read this year, hands down, is How to Fly a Horse by Kevin Ashton. Using examples of true disruptive innovations over the last century, Ashton explains not only the process of creating a disruptive innovation but its required environment as well. It inspired me to write an entire series of post on creativity and innovation, creativity stimuli, creativity killers and how to foster innovation in large corporations. The posts on this blog are in French but I translated the first one on Medium. The others will follow in the New Year.

The very best book on innovation I read this year, hands down, is How to Fly a Horse by Kevin Ashton. Using examples of true disruptive innovations over the last century, Ashton explains not only the process of creating a disruptive innovation but its required environment as well. It inspired me to write an entire series of post on creativity and innovation, creativity stimuli, creativity killers and how to foster innovation in large corporations. The posts on this blog are in French but I translated the first one on Medium. The others will follow in the New Year.

Although not on innovation per se, Mindset: The new psychology of success written by psychologist Carol Dweck is a fantastic book that will help marketers, innovators and entrepreneurs foster an attitude that will, along with hard work, lead them to success. It was recommended to me by a colleague and I since recommended the book to a few friends and acquaintances. Most of them said it was one of, or the best, and most useful book they read in a long time.

Although not on innovation per se, Mindset: The new psychology of success written by psychologist Carol Dweck is a fantastic book that will help marketers, innovators and entrepreneurs foster an attitude that will, along with hard work, lead them to success. It was recommended to me by a colleague and I since recommended the book to a few friends and acquaintances. Most of them said it was one of, or the best, and most useful book they read in a long time.

Lean Startup

Dozens of Lean Startup related books covering topics from management, finance, marketing, corporate culture, analytics, product management and others came out in 2015. There were too many to read. Amazon’s list of Lean Startup related books to be published in 2016 makes me think that all the Lean Startup related books written in 2015 will only amount to a fraction of what is coming next year. Erie Ries himself (Lean Startup author) will be publishing a second book called The Leaders’ Guide, in 2016.

I was even inspired myself this year to create some Lean Startup content. I shared with my readers the Marketing Minimum Viable Plan (Marketing MVP) in a series of 3 posts (part 1, part 2 and part 3).

I was even inspired myself this year to create some Lean Startup content. I shared with my readers the Marketing Minimum Viable Plan (Marketing MVP) in a series of 3 posts (part 1, part 2 and part 3).

Three of the books based on Lean Startup principles that stood out from the others for me were the following.

The Lean Product Playbook: How to innovate with Minimum Viable Products and Rapid Customer Feedback from Dan Olsen is one of them. It will help anyone developing a new product figure out how to apply Lean Startup principles and minimize commercialisation risks for their specific situation. It is well written and has loads of pertinent examples to facilitate comprehension of various concepts. It inspired me to write a post on product/market fit.

The Lean Product Playbook: How to innovate with Minimum Viable Products and Rapid Customer Feedback from Dan Olsen is one of them. It will help anyone developing a new product figure out how to apply Lean Startup principles and minimize commercialisation risks for their specific situation. It is well written and has loads of pertinent examples to facilitate comprehension of various concepts. It inspired me to write a post on product/market fit.

Lean Enterprise: How corporations can innovate like start-ups by Trevor Owen is another book that stood out. Based in large part on Christensen’s Innovator’s Dilemma, it clearly shows the barriers to innovation in large corporations. It also talks about the concept of innovation colonies and many of the practical aspects of setting up innovation friendly environments in large businesses.

Lean Enterprise: How corporations can innovate like start-ups by Trevor Owen is another book that stood out. Based in large part on Christensen’s Innovator’s Dilemma, it clearly shows the barriers to innovation in large corporations. It also talks about the concept of innovation colonies and many of the practical aspects of setting up innovation friendly environments in large businesses.

Finally Lean B2B: Build Products Businesses Want by Etienne Garbugli is a comprehensive look at developing B2B products using Lean Startup principles. It takes a practical, hands-on approach which shows you step by step how Lean Startup product management is done in a B2B environment. It is the only book on Lean Startup I read that uses a layout and techniques one usually finds in textbooks to facilitate comprehension.

Finally Lean B2B: Build Products Businesses Want by Etienne Garbugli is a comprehensive look at developing B2B products using Lean Startup principles. It takes a practical, hands-on approach which shows you step by step how Lean Startup product management is done in a B2B environment. It is the only book on Lean Startup I read that uses a layout and techniques one usually finds in textbooks to facilitate comprehension.

This rounds up my list of best business reads for 2015.

Thank you for having taken the time to read the TechnoMarketing blog this year.

I would like to wish you and yours happy holidays and a healthy and fruitful 2016.

by Rita Baker | Nov 25, 2015 | Lean Startup

Every start-up is looking for the elusive product-market fit. It’s the only way to get to the hockey stick market growth that can eventually lead to unicorn land.

Finding the product-market fit is this magical moment in time when a corporation has found the market(s) who perceive the value proposition of their product to be irresistible.

The three parts of the product-market fit definition

The first part is finding a (or a few) market(s) who perceive(s) your product as irresistible. This means you have found[1] a market which has unmet needs that they consider important enough to want to pay you, rather than anyone else, to fulfill them.

What is important to remember is that the needs to be fulfilled are often not directly related to the product itself. They are peripheral needs that the solution, which envelops the product, will fulfill.

The Uber taxi service is an example. Its customers are not choosing them over the many competing taxi services because they want to satisfy the need to get from point A to point B. They are choosing to give their money to Uber and its drivers mostly because Uber made it easier to order and pay for a taxi ride from their cell phone. Also because the passenger has an important say in who gets not only to drive him or her but to drive a Uber taxi.

The second part of the product-market fit definition is creating the value proposition which will prove irresistible. In order to provide significant gains, reduce some of the pains a market segment is experiencing, and help them do their jobs (real of figurative) more efficiently, you need to understand not only their needs but the environment in which they are felt.

The second part of the product-market fit definition is creating the value proposition which will prove irresistible. In order to provide significant gains, reduce some of the pains a market segment is experiencing, and help them do their jobs (real of figurative) more efficiently, you need to understand not only their needs but the environment in which they are felt.

The third part of the product-market fit definition is the moment in time aspect. The product market fit has a start and a finish in time. It does not last forever once you have found it. It is tributary to a slew of variables that all need to be within a certain range for the fit to happen. As soon as one of the critical variables, or a sufficient amount of non critical ones, move outside of the ideal range, the fit disappears.

How to achieve product-market fit

Achieving product-market fit can only be done through trials, errors and adjustments.

The fastest way to achieve product-market fit is to start with intimate knowledge of how one or a few market segments, with sufficient purchasing power for your product, fulfill one or many needs.

It is then a matter of translating this information into a solution with an irresistible value proposition to these markets.

This approach is significantly faster than developing a product for which you don’t have a specific market in mind and hence don’t know exactly which needs you will be fulfilling.

This approach entails that you need to guess which market segment will find your value proposition irresistible then get to understand their needs. You then either must adapt your product to this new information, or if the value proposition is unappealing to this particular segment, move on to another and repeat the process.

The risk of running out of funds is significantly higher with the second approach.

How to know when you have achieved product-market fit

There are a few indicators that will allow you to know when -your product-market fit has been achieved.

There are a few indicators that will allow you to know when -your product-market fit has been achieved.

The one I find the simplest is to plot on a graph your sales to total marketing costs (which includes your promotion costs) ratio over time for a specific market segment. If you are targeting multiple segments, you will need to allocate a part of your marketing costs for each segment.

When you see constant growth for a period equivalent to 4 to 6 sales cycle, you will have achieved product-market fit. A sales cycle beign defined as the time it takes a customer to go through the sales funnel (from awareness stage to purchase). Hence if your sales cycle is 7 days, you will need to see one month to one and a half month of constant growth of your sales to marketing cost ratio. If your sales cycle is a month long then you will need to observe 4 to 6 months of constant growth to know you have achieved your product-market fit.

You’ll want to keep an eye out for non-replicable events. If you are selling a new type of snow shovels, for example, and an unexpected heavy snowfall occurs, you will need to remove the period of the snowfall from your data.

Finding the product-market fit is the holy grail of any start-up. It is the acid test which lets you know your efforts were not in vain.

Now all that is left to do is find new markets so you can scale your business and keep a constant eye on your current one to make sure you don’t lose your product-market fit.

Can I get you a coffee or a Red Bull perhaps?

[1] In rare occasions, the market has found them

What is Lean Startup?

What is Lean Startup? Why we need Lean Startup

Why we need Lean Startup

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions.

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions. However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future.

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future. When presenting this forecast, you can most likely do so with a straight face with the numbers for the first few months. You know very well, however, that any number past this time horizon is based on wishful thinking rather than any market facts. Market facts would require some kind of market history. The problem is that a disruptive innovation is, by definition, not found in the market. Hence, keeping a straight face in front of an investor requires serious acting talent on your part. Fearing that at any time you will be called out.

When presenting this forecast, you can most likely do so with a straight face with the numbers for the first few months. You know very well, however, that any number past this time horizon is based on wishful thinking rather than any market facts. Market facts would require some kind of market history. The problem is that a disruptive innovation is, by definition, not found in the market. Hence, keeping a straight face in front of an investor requires serious acting talent on your part. Fearing that at any time you will be called out.

Innovation accounting is defining, measuring and communicating the process of innovating either in the context of a start-up or a project in an established organisation.

Innovation accounting is defining, measuring and communicating the process of innovating either in the context of a start-up or a project in an established organisation.

Hubspot

Hubspot CCO Magazine

CCO Magazine The very best book on innovation I read this year, hands down, is How to Fly a Horse by Kevin Ashton. Using examples of true disruptive innovations over the last century, Ashton explains not only the process of creating a disruptive innovation but its required environment as well. It inspired me to write an entire series of post on

The very best book on innovation I read this year, hands down, is How to Fly a Horse by Kevin Ashton. Using examples of true disruptive innovations over the last century, Ashton explains not only the process of creating a disruptive innovation but its required environment as well. It inspired me to write an entire series of post on  Although not on innovation per se, Mindset: The new psychology of success written by psychologist Carol Dweck is a fantastic book that will help marketers, innovators and entrepreneurs foster an attitude that will, along with hard work, lead them to success. It was recommended to me by a colleague and I since recommended the book to a few friends and acquaintances. Most of them said it was one of, or the best, and most useful book they read in a long time.

Although not on innovation per se, Mindset: The new psychology of success written by psychologist Carol Dweck is a fantastic book that will help marketers, innovators and entrepreneurs foster an attitude that will, along with hard work, lead them to success. It was recommended to me by a colleague and I since recommended the book to a few friends and acquaintances. Most of them said it was one of, or the best, and most useful book they read in a long time. I was even inspired myself this year to create some Lean Startup content. I shared with my readers the

I was even inspired myself this year to create some Lean Startup content. I shared with my readers the  The Lean Product Playbook: How to innovate with Minimum Viable Products and Rapid Customer Feedback from Dan Olsen is one of them. It will help anyone developing a new product figure out how to apply Lean Startup principles and minimize commercialisation risks for their specific situation. It is well written and has loads of pertinent examples to facilitate comprehension of various concepts. It inspired me to write a

The Lean Product Playbook: How to innovate with Minimum Viable Products and Rapid Customer Feedback from Dan Olsen is one of them. It will help anyone developing a new product figure out how to apply Lean Startup principles and minimize commercialisation risks for their specific situation. It is well written and has loads of pertinent examples to facilitate comprehension of various concepts. It inspired me to write a Lean Enterprise: How corporations can innovate like start-ups by Trevor Owen is another book that stood out. Based in large part on Christensen’s Innovator’s Dilemma, it clearly shows the barriers to innovation in large corporations. It also talks about the concept of innovation colonies and many of the practical aspects of setting up innovation friendly environments in large businesses.

Lean Enterprise: How corporations can innovate like start-ups by Trevor Owen is another book that stood out. Based in large part on Christensen’s Innovator’s Dilemma, it clearly shows the barriers to innovation in large corporations. It also talks about the concept of innovation colonies and many of the practical aspects of setting up innovation friendly environments in large businesses. Finally Lean B2B: Build Products Businesses Want by Etienne Garbugli is a comprehensive look at developing B2B products using Lean Startup principles. It takes a practical, hands-on approach which shows you step by step how Lean Startup product management is done in a B2B environment. It is the only book on Lean Startup I read that uses a layout and techniques one usually finds in textbooks to facilitate comprehension.

Finally Lean B2B: Build Products Businesses Want by Etienne Garbugli is a comprehensive look at developing B2B products using Lean Startup principles. It takes a practical, hands-on approach which shows you step by step how Lean Startup product management is done in a B2B environment. It is the only book on Lean Startup I read that uses a layout and techniques one usually finds in textbooks to facilitate comprehension.