by Rita Baker | Mar 29, 2016 | Marketing

When I first heard the term growth hacking, about 5 years ago, I thought Great! Some unscrupulous marketer is at it again. In my head hacking meant doing something either illegal or unethical. Either way, it wasn’t going to be good for business in the long run and whoever was doing it would figure it out sooner or later. Hence I dismissed it.

During the following couple of years, I stumbled upon an increasing number of posts and web articles on growth hacking. The authors described tactics they had used and stated the impressive results they had achieved in attracting users to an application or a website while spending very little money. Many of these tactics were creative and the vast majority of them were neither illegal nor unethical. I had to know more, so I researched growth hacking thoroughly.

I started by going to Sean Ellis’s first post on the topic where he coined the term. That honestly didn’t give me much to go on. Since I’m a firm believer in the need to understand the context in order to truly understand the problem, my second step was to study who Sean Ellis was. What was the road that led him to create the growth hacking concept?

Sean’s professional journey led him first to a commission only sales job in Budapest, in a pretty cut-throat environment, selling advertising for publications. The guy did brilliantly. In order to do so however, he had to get very creative. Then he headed to Silicon Valley for short stints (less than a year) at Dropbox and Eventbrite where he was hired specifically to grow their user base. At that time he was also active in multiple technological start-ups in the valley, helping them not only with their marketing but also often acting as an angel investor. He went on to become a serial entrepreneur. Hence his business culture is soaked with the Silicon Valley culture where fast growth and big numbers (where the money comes from is secondary) are what counts most.

Understanding the creator’s journey and the environment in which it was created can help you understand where growth hacking shines and where it doesn’t.

Like any other business concept, growth hacking is not a panacea. It isn’t applicable in all situations, in all companies, at all times.

Growth hacking can be described as creative digital marketing tactics, aimed specifically at web user base growth, that are best suited for web based products/services during the start-up phase, immediately after product/market fit stage. This is when scaling the business goes from back burner to front of mind.owth hacking can be described as creative digital marketing tactics, aimed specifically at web user base growth, that are best suited for IT products/services during the start-up phase immediately after product/market fit stage.GG

Are you confused yet? I didn’t think so. When applied the way it was intended to, a good business concept usually isn’t confusing.

It gets confusing when the concept starts being applied when it shouldn’t or in situations it isn’t intended for. This isn’t to say that a concept shouldn’t evolve and be adapted to new situations and contexts. The message here is, when it is, it must be done carefully in order to preserve the concept’s value.

It gets confusing when the concept starts being applied when it shouldn’t or in situations it isn’t intended for. This isn’t to say that a concept shouldn’t evolve and be adapted to new situations and contexts. The message here is, when it is, it must be done carefully in order to preserve the concept’s value.

A good example of an evolved application of growth hacking is when it is used by large corporations to grow their user base of a new (or even an existing) product. Only a few years back an active social media presence, cross promotions, webinars, Facebook contests and selling their apps through the iStore or Google app store could all be have been considered growth hacks in large corporations. Today, these same marketers would need to be more creative in their tactics to be counted as growth hackers. The tactics, whatever form they take, are a part of an overall marketing plan and, when well executed, give fast and excellent results in growing the user/customer base.

Here are a couple of situations that I was exposed to in recent months which confused the heck out of me. They also show that comprehension and application of a good business concept can get distorted to the point of being harmful.

Here are a couple of situations that I was exposed to in recent months which confused the heck out of me. They also show that comprehension and application of a good business concept can get distorted to the point of being harmful.

The first one was an 18 month old start-up that was a B2B reseller (of non IT products). It used the web as one of its distribution channel. When I asked the owner who was doing his marketing strategy he proudly said to me; We don’t waste time with marketing, we only do growth hacking and sales. I asked him what growth hacking entailed for his company. He went on to describe various digital marketing tactics, some aimed at finding new customers and others aimed at brand recognition (hence not growth hacking). The web developer who he had employed as his growth hacker did use analytics but wasn’t familiar with cohort analysis or the sales funnel. Aside from transferring email addresses, his growth hacking tactics would generate, to the person responsible for sales in non web channels, there was no other coordination between the two. When I asked the head of sales how useful these email addresses were he rolled his eyes and let out an exasperated sigh. In the end, growth hacking was costly and had little to no impact on revenues in this situation.

Growth hacking is NOT a replacement for marketing. It is one of the categories of digital marketing tactics that can be used in specific situations to generate users, members, contributors and/or email lists (amongst others). Growth hacking has little or no value if it isn’t part of an overall marketing strategy.

The second situation, and I have seen it more than once, is when a founder or co-founder tags him or herself as Chief Growth Hacker. From day one, their focus is on growing their potential user (fan) base. The product is nowhere near being ready, the target customers still change every other week and product/market fit is nowhere in sight. Growing your user/customer base is a valid concern, even on day one, but growth hack tactics should not be how you find your first customers. Even if you have a web only based business, your first customers should be people you first approach and meet face to face. People you can observe in various situations. People who have no restrictions (or constraints) in telling you what they like and don’t like about your product idea. People you get to know inside out. Most of the users generated by growth hacking tactics before you achieve product/market fit will not convert into paying customers.

When you have not yet achieved product/market fit, you are better off having only a few customers (willing to pay you), that you know inside out, than having a large base of potential non-paying customers that you know only superficially. Once you know your various customer segments intimately and have found the product that they can’t live without, then will be the time to put massive efforts into growth hacking.

Yes, showing a large number of potential customers early can make potential investors notice your start-up. However, unless you can convert a large proportion of these potential customers into paying customers soon, which won’t happen if you haven’t reached product/market fit, the investors will disappear faster than you can snap your fingers.

If you are a founder, and thinking about using growth hacking, the takeaways are:

- Make sure the timing and contexts are right for it

- Growth hacking is not a substitute for marketing. It is but one of its components

- Growth hacking requires skills in analytics. Ensure you have those skills in your company before attempting it

- Growth hacking is not a magic bullet. It will not ensure your start-up’s success by itself.

If this post has raised any questions in your mind about growth hacking, feel free to contact Baker Marketing. We’ll be happy to help you answer them if we can.

by Rita Baker | Mar 10, 2016 | Lean Startup

***This post has been revised following some input by David Binetti ***

Now that we have looked at the why, what and how of innovation accounting, let’s dig deeper and take a look at one of the most exciting tools to come out of innovation accounting: Innovation options.

What are Innovation Options?

Innovation options, created by the father of innovation accounting, David Binetti, follow a similar principle to financial market options.

In finance, an option is a contract which gives the buyer the right, but not the obligation, to buy or sell an asset or instrument at a specified strike price on or before a specified date. In everyday life, we use the option principle when we buy a life insurance policy.

An innovation option is a financial instrument which lets a potential investor see the maximum market value of a start-up or other innovation project at a specific date in time. It also shows the overall risk of the project. Hence the investor can choose when and how much to invest according to the return/risk ratio he/she is looking for.

Innovations options are meant to be used with disruptive innovation projects. When there is no presumption of success.

How do Innovation Options Work?

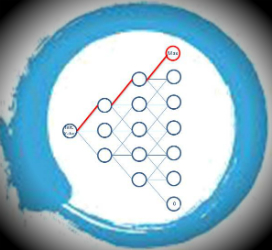

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

Given the formula may scare off even the bravest of us, I will instead direct you to a web page David has gracioulsy put up (http://innovation-options.com/) where you can input your data and the embedded program will make the calculations.

The model calculates every possible value of a start-up or innovation project, at a given date, for three types of outlooks: positive, neutral or negative.

In order to get to the potential values at time x of your project or start-up, you need to input the following data in the model.

Costs

There are two types of costs; your seeding costs, the ones associated with your inital funding needs and the costs associated with taking your company or project to the next level aka the big bet.

Your seeding costs include the funds needed to cover your initial start-up activities in order to test your hypotheses and get to a point where you are reasonably certain you have achieved product/market fit. This can be seen as the premium on the option itself.

The second type of costs are the ones associated with scaling your company or taking your project to the next level (provisioning costs). It could mean going from prototype mode to full blown internal production and/or going from addressing local markets to going after international markets.

Potential

Your start-up or project potential refers to what you think it’s market value will be at the term of the option. There are many ways to estimate this number. It is a function of your revenues, assets and intangibles. It is the answer to What do you think your start-up or project could sell for (after the seeding round or scalling depending on the type of financing you are looking for) in the market?

Time horizon (or option term)

This period is usually defined by the duration of your project or how long you can last given the amount of money you are asking for (aka your runway).

Number of reporting periods

The innovation option framework is based on using some kind of agile, iterative development methodology such as Lean Startup. Hence you need to decide how often you will report the results of your experiments to your investors. These reports should include the type of information you have in your innovation accounting log.

The output of a model, with 3 reporting periods, will look like this:

Each vertical row of values represents a reporting period. In order to get to your startup/project maximum valuation (top right corner), you simply need to see if your experiment results for the period proved your assumptions (you go up), were inconclusive (you go straight), or disproved your assumptions (go down). A scenario where your experiments proved your underlying assumptions for all reporting periods would look like this:

Aside from this graph, the econometric model will also yield the risk sigma (or measurement of the level of risk) of the project. The risk sigma is a comparable measure between projects that is inversely related to the number of reporting periods. In other words, the faster (and more often) you iterate on your market experiments the lesser the overall risk of the project (but the higher the costs as well[1]). If you think about this a bit it’s just common sense. The more often you check in with your potential customers to ensure the product you are working on answers their needs, the higher the probability they will buy it once it’s in the market. You can check out David Binetti’s presentation at the 2015 Lean Startup Conference for additional information on how the innovation option model works.

Why are Innovation Options Game Changers?

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions.

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions.

Investors will have a framework that reassures them that all is being done to minimise the commercialisation risk of the project. They will also be able to compare the risk of one project to others and pick the ones that fit best with the overall risk/return strategy they have for their portfolio.

Investors will be able to easily put a $ value to any project thus making it possible for companies of all sizes, and not just entrepreneurs, to work internally on disruptive innovation projects.

Finally, one could even see down the road, banks and other more conservative financial institutions getting into innovation financing at earlier stages. This will result in more financing options for entrepreneurs and intrapreneurs thus decreasing the cost of funding a project.

As an end result, it would make disruptive innovations a more mainstream occurrence. This would have a pretty significant impact on our economies and our lives.

What is Needed to Get There

However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

Finally, the biggest obstacles to overcome, in the use of innovation accounting and innovation options, are the culture and the required changes in the ecosystems of the financial sector. These sectors have deeply entrenched ways of doing things and are not innovative by nature.

It may just take a Google, Amazon, Intuit or other innovator, outside of the financial sector, to start financing innovations at large and shake things up.

Will innovation accounting and innovation options be the meta disruptive innovations that will bring about profound changes in the creation of disruptive innovations? The potential is there.

[1] Hence, learning how to do your experiments with the least amount of resources (MVP way) will increase the maximum value of your start-up/project.

by Rita Baker | Mar 2, 2016 | Lean Startup

In the previous post we looked at why we need innovation accounting and its definition. This post’s purpose is to understand how innovation accounting is done.

When working on getting an innovation to market, whether while setting up a new company or through an internal project, you first start with an idea. Through a series of experiments you test your idea and refine it until you can reach your goal (usually when starting a new company the goal is to achieve product/market fit).

Innovation accounting is the defining, measuring and communicating of this series of experiments. This can be done a number of ways. When using the Lean Startup methodology, it is done through the Build-Measure-Learn process.

Eric Ries’ The Lean Startup book explains in detail the methodology and you can also find over a dozen videos on the web that details how to conduct an experiment. The Javelin experiment board video is a classic. Hence I will only give a brief summary of the methodology here.

Innovation Accounting Step 1: Build

Once you have identified your most critical assumption in your business model (one that must be verified in order for your business to be viable), you design an experiment to test your assumption.

It is important for your assumption to be worded in such a way that it can be validated or invalidated.

The experiment you design must allow you to test your assumption with the least amount of resources possible.

Ideally, your first experiments will be conducted directly with your target market. Either by observing them (ideal), having them act within a specific scenario (also ideal) or by interviewing them (less ideal).

Innovation Accounting Step 2: Measure

When designing your experiment, you will need to determine which metrics will be collected as well as a standard against which you will measure them.

Metrics collected from the web will come from your analytics data. Metrics coming from other sources will most often be collected manually.

Statistically reliable data is not necessary here. You simply need sufficient data to show a direction.

In the context of innovation accounting, your data must be actionable (it must tell you explicitly whether your can pursue your business model in its current form or whether you need to change it) and accountable (you should be able to recreate your experiment at a later date and get similar findings).

Above all, just like it is the case with regular accounting, your experiment must be conducted rigorously, using the highest standards. Otherwise the results of your experiments will be unreliable.

Knowledge in analytics and primary data collection are necessary to conduct valid experiments.

It is important to note here that innovation accounting is a burgeoning discipline. One of the areas that still needs to grow in order to provide better guidelines is how to pick standards for your experiments. At this time, it is left to the market experience of the entrepreneur to determine a standard for an experiment.

Innovation Accounting Step 3: Learn

Learning, while conducting your first experiments, is easy. You have not invested much time or resource in your project yet and backtracking, although not pleasant, can be done easily. As more resources are sunk into the project, pivoting on essential parts of your business model becomes increasingly difficult.

Validating your critical assumptions is the primary goal of your experiments. There is however, a very important secondary goal. That is to keep your eyes and ears open for any other learnings you can pick up along the way. Your early experiments are the ones that will most likely yield the most secondary learnings. Some of these learnings will be so critical that they may impact your business model just as much as not validating your assumption would.

Your innovation accounting log

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future.

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future.

Given I am fundamentally lazy and like simplicity above all, I use an Excel spreadsheet to keep a log of my experiments. The variables I keep track of, for each experiment I conduct, are the following:

- Critical assumption

- Market targeted

- Number of participants required

- Summary description of the experiment

- Start date of experiment

- End date of experiment

- Resources required

- What does my minimum viable product consist of

- Metric(s) to be measured

- Standard of the experiment

- Experiment results

- Additional learnings

- Has the critical assumption been validated or not?(color code the cell green or red)

- If not, what is the impact on the business model?

As you fill in your spreadsheet with the results of your numerous experiments, you are tracking innovation. The spreadsheet also serves to show, not only potential investors but collaborators as well, the road you have travelled to get to where you are. Too often it is thought that innovation is born from a single genius idea and a bit of work.

The innovation accounting log shows the size of the effort and the progression of ideas required to bring an innovation to market

Our third and last post of this series will take a look at how innovation options, a disruptive innovation in itself, can determine the maximum market value of an innovation.

It gets confusing when the concept starts being applied when it shouldn’t or in situations it isn’t intended for. This isn’t to say that a concept shouldn’t evolve and be adapted to new situations and contexts. The message here is, when it is, it must be done carefully in order to preserve the concept’s value.

It gets confusing when the concept starts being applied when it shouldn’t or in situations it isn’t intended for. This isn’t to say that a concept shouldn’t evolve and be adapted to new situations and contexts. The message here is, when it is, it must be done carefully in order to preserve the concept’s value. Here are a couple of situations that I was exposed to in recent months which confused the heck out of me. They also show that comprehension and application of a good business concept can get distorted to the point of being harmful.

Here are a couple of situations that I was exposed to in recent months which confused the heck out of me. They also show that comprehension and application of a good business concept can get distorted to the point of being harmful.

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

The innovation option model is based on a trinomial tree option pricing formula that is used to calculate financial options values at specific dates.

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions.

Once the innovation accounting framework is perfected (there are still some subjective parts in the process), it will greatly reduce the commercialisation risk associated with creating disruptive innovations. Entrepreneurs and product creators will have an easier time to get funding. They will also spend their time getting to the knowledge of whether their idea is marketable or not instead of creating spreadsheets with large numbers of unverifiable assumptions. However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

However, we are not there quite yet. Innovation accounting and innovation options are still in their early, if not embryonic, stages. More guidelines on how experiments are conducted and standards are selected are still needed. This will require more practice and case studies to refine the innovation accounting framework, and possibly, the innovation option formula.

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future.

Drawing a parallel to traditional accounting, you need to keep records of all of your experiments. There are no guidelines established yet showing us how to do this. I will share with you how I keep track of my experiments. Keep in mind that better ways will be developed in the future.